Take Control—Master Your Finances with Ease

Easily track spending, set budgets, and plan for your financial goals, all in one place!

Benefits You'll Love

- Effortless access to information like spending habits, debt, and trends

- No extra apps to install or additional tools to learn

- Ability to import other financial data, such as non-First Federal account balances

Easily Understand Your Finances

When it comes to achieving your goals—whether you’re hoping to buy a home, start a family, or plan for retirement—the sky is the limit… as long as you know your limits.

Realizing your dreams isn’t always easy. First Federal knows this and wants to help.

That’s why we’ve put comprehensive views of your financial information right within your online banking session. You’ll have effortless access to information like spending habits, debt, and trends revealed within your First Federal accounts—and you’ll also be able to import other financial data, such as non-First Federal account balances. You’ll have everything you need within one simple view, so that you can see the complete picture of where your finances stand.

There are no extra apps to install or additional tools to learn—it’s all presented simply within your online banking session, making financial planning an effortless part of your daily experience, so that it’s simple to budget better for the things in life that matter most.

You’ll get quick, easy-to-understand views of:

- Budgets

- Spending

- Net Worth

- Debts

- Trends

To get started, just log into your First Federal Online Banking today!

{beginAccordion}

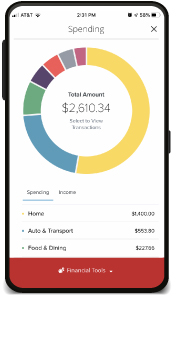

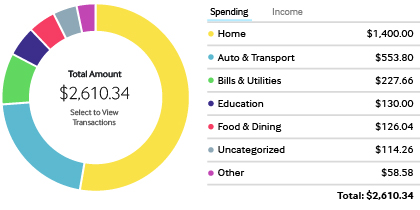

Spending

Displays your categories of spending for the time selected.

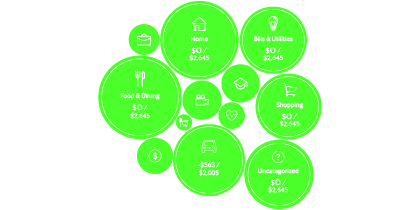

Budgets

There are two options for generating a budget: system-generated and user-created. The system-generated budget is based on your past few months of data. The more complete and accurate your categorization is, the more accurate your results will be.

Alternatively, you can manually create specific budget line items that you want to track.

Net Worth

Display information from your accounts available, either accounts with First Federal or those you’ve added into your view from other institutions.

</p

</p

Trends

Provides an overview of spending trends over a period of time. This is especially useful if you are tracking a particular category of spending, such as eating out, and want a high-level view of your efforts.

Debts

See a list of all your debts in one central view. Modify your payment plan between popular payment strategies such as highest interest rate, lowest balance, and see the effect it could have on your timeline of being debt-free.

Tips

TIP #1

For a more complete picture of your finances, make sure to link your non-First Federal accounts!

Click on Link Account on your Online Banking Home Page, or within Financial Tools. Search for the account institution and provide your username and password.

TIP #2

You can hide accounts from your Financial Tools.

From the navigation Menu select Settings, Account Preferences, then select the account you would like hidden. Under the Account Visibility options, un-check Financial Tools. Repeat these steps for each account you want to hide.

TIP #3

Login to First Federal Online Banking and get started today!

If you aren't already enrolled in Online Banking: CLICK HERE

If you have any problems getting started, feel free to give us a call at 208-733-4222, and we'll be glad to help!

{endAccordion}

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly interest earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Business Money Market

| Tier | Average Daily Balance Range | Interest Rate | Annual Percentage Yield (APY) |

|---|---|---|---|

| 1 | Below $1,000.00 | 0.0500% | 0.05% |

| 2 | Equal to or greater than $1,000.00 but less than $10,000.00 | 0.2000% | 0.20% |

| 3 | Equal to or greater than $10,000.00 but less than $25,000.00 | 0.4000% | 0.40% |

| 4 | Equal to or greater than $25,000.00 but less than $50,000.00 | 0.6500% | 0.65% |

| 5 | Equal to or greater than $50,000.00 but less than $100,000.00 | 0.8500% | 0.85% |

| 6 | Equal to or greater than $100,000.00 but less than $250,000.00 | 1.1000% | 1.11% |

| 7 | Equal to or greater than $250,000.00 but less than $500,000.00 | 1.6000% | 1.61% |

| 8 | Equal to or greater than $500,000.00 but less than $1,000,000.00 | 2.1000% | 2.12% |

| 9 | Equal to or greater than $1,000,000.00 but less than $2,500,000.00 | 2.6000% | 2.63% |

| 10 | Equal to or greater than $2,500,000.00 | 3.0000% | 3.04% |

Rates are accurate as of 2/3/2026. Your interest rate and annual percentage yield may change. At our discretion, we may change the interest rate on your account. We may change the interest rate on your account at any time. There are no maximum or minimum interest rate limits for this account. Interest will be compounded monthly and will be credited to the account monthly. If you close your account before interest is credited, you will receive the accrued interest. You must deposit $1,000.00 to open this account. A service fee of $10.00 will be imposed every month if the average daily balance for the month falls below $1,000.00. You must maintain a minimum average daily balance of $5.00 to obtain the disclosed annual percentage yield. A dormant account fee of $5.00 per month will be charged after 12 months of inactivity. Interest earnings credited to the account, if any, are not considered account activity.

We use the average daily balance method to calculate interest on your account. This method applies a periodic rate to the average daily balance in the account for the period. The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period. The average daily balance that we use when calculating interest is the collected balance. That means we only include those funds for which we have actually received payment when we determine the average daily balance on which interest is paid. Interest begins to accrue no later than the business day we receive credit for the deposit of noncash items (for example, checks). Withdrawals from your MMDA are limited to six (6) per statement cycle. A fee of $10.00 will be charged for each transaction in excess of limit. Please refer to the separate Fee Schedule provided to you with this disclosure for information about fees and charges associated with this account. A Fee Schedule will be provided to you at the time you open an account, periodically when fees or charges change, and upon request.

Certificates of Deposit (CDs)

| Term | Interest Rate | APY |

|---|---|---|

| 5-Month Rate w/ Checking1 | 3.50% | 3.56% |

| 5-Month Rate w/o Checking1 | 2.91% | 2.95% |

| 3 Months | 3.45% | 3.51% |

| 6 Months | 3.30% | 3.35% |

| 12 Months | 3.25% | 3.30% |

| 18 Months | 3.15% | 3.20% |

| 30 Months | 3.20% | 3.25% |

| 4 Years | 3.30% | 3.35% |

| 5 Years | 3.35% | 3.40% |

$500 Minimum Deposit to Open.

Interest rates and APYs are accurate as of 1/1/2026. Rates are subject to change at any time.

Annual Percentage Yield (APY) assumes interest credited is not withdrawn until maturity or renewal. Principal withdrawals prior to the maturity or renewal date may be subject to early withdrawal penalties. Penalties are not assessed if the account holder is deceased. Renewal grace period is seven (7) calendar days. Fees may reduce earnings on the account.

1Customers with a new or existing First Federal checking account earn 3.50% with an annual percentage yield (APY) of 3.56%. This APY is accurate as of 2/3/2026. This offering is for a limited time and subject to change at any time. Interest will be compounded and credited monthly. The APY assumes there are no withdrawals until maturity or renewal. Customers without a First Federal checking account earn 2.91% with an annual percentage yield (APY) of 2.95%. All other terms and conditions referenced above (*) apply.

Home Equity Loans

Rates and APRs below as of 03/03/2026.

| Product | Rate | APR |

|---|---|---|

| Home Equity Line of Credit (HELOC)1 | 6.500% | 6.523% |

| Home Equity Loan2 | 6.000% | 6.034% |

For products not listed above, including government insured, please call (208) 733-4222.

1HELOC stated Annual Percentage Rate (APR) subject to criteria, including automatic payment from a First Federal checking account. HELOC initial payment is interest-only. Line of credit is accessible for ten years followed by a fifteen-year repayment period. Variable interest rate may increase after consummation. Property insurance may apply. Maximum APR of 18.00%. Borrower may be responsible for third-party costs that may range from $250 to $5,000. Borrower is responsible for appraisal fees on loans exceeding $400,000. In Idaho, the title insurance premium (if applicable) and mortgage recording tax will be based on the maximum amount of the credit line available to you, regardless of how much is advanced to you at any time. Rate quoted is for liens in first position. Loans in second lien position will have higher rates.

2Rates vary by qualification and term selected. Rate quoted is for liens in first position. Loans in second lien position will have higher rates.

Jumbo Certificates of Deposit

| Term | Interest Rate | APY |

|---|---|---|

| 5 - Month Rate w/ Checking1 | 3.60% | 3.66% |

| 5 - Month Rate w/o Checking1 | 3.01% | 3.05% |

| 3 Months | 3.55% | 3.61% |

| 6 Months | 3.40% | 3.45% |

| 12 Months | 3.35% | 3.40% |

| 18 Months | 3.25% | 3.30% |

| 30 Months | 3.30% | 3.35% |

| 4 Years | 3.40% | 3.45% |

| 5 Years | 3.45% | 3.51% |

$100,000 minimum deposit to open.

Interest rates and APYs are accurate as of 1/1/2026 Rates are subject to change at any time.

Annual Percentage Yield (APY) assumes interest credited is not withdrawn until maturity or renewal. Principal withdrawals prior to the maturity or renewal date may be subject to early withdrawal penalties. Penalties are not assessed if the account holder is deceased. Renewal grace period is seven (7) calendar days. No minimum balance is required to obtain the disclosed APY. Fees may reduce earnings on the account.

1 Customers with a new or existing First Federal checking account earn 3.60% with an annual percentage yield (APY) of 3.66%. This APY is accurate as of 2/3/2026. This offering is for a limited time and subject to change at any time. Interest will be compounded and credited monthly. The APY assumes there are no withdrawals until maturity or renewal. Customers without a First Federal checking account earn 3.01% with an annual percentage yield (APY) of 3.05%. All other terms and conditions referenced above (*) apply.

Kasasa Cash*

| Balance | Minimum Opening Deposit | Rate | APY |

|---|---|---|---|

| 0 - $15,000 | $x | 0.00% | 0.00% |

| $15,000+ | $x | 0.00% | 0.00% |

| All balances if qualifications not met | $x | 0.00% | 0.00% |

Qualifications

xx

Kasasa Saver*

| Balance | Minimum Opening Deposit | Rate | APY |

|---|---|---|---|

| 0 - $15,000 | $x | 0.00% | 0.00% |

| $15,000+ | $x | 0.00% | 0.00% |

| All balances if qualifications not met | $x | 0.00% | 0.00% |

Qualifications

xx

Loan Rates

Loan Rates

Money Market

| Tier | Average Daily Balance Range | Interest Rate | Annual Percentage Yield (APY) |

|---|---|---|---|

| 1 | Below $1,000.00 | 0.0500% | 0.05% |

| 2 | Equal to or greater than $1,000.00 but less than $10,000.00 | 0.2000% | 0.20% |

| 3 | Equal to or greater than $10,000.00 but less than $25,000.00 | 0.4000% | 0.40% |

| 4 | Equal to or greater than $25,000.00 but less than $50,000.00 | 0.6500% | 0.65% |

| 5 | Equal to or greater than $50,000.00 but less than $100,000.00 | 0.8500% | 0.85% |

| 6 | Equal to or greater than $100,000.00 but less than $250,000.00 | 1.1000% | 1.11% |

| 7 | Equal to or greater than $250,000.00 but less than $500,000.00 | 1.6000% | 1.61% |

| 8 | Equal to or greater than $500,000.00 but less than $1,000,000.00 | 2.1000% | 2.12% |

| 9 | Equal to or greater than $1,000,000.00 but less than $2,500,000.00 | 2.6000% | 2.63% |

| 10 | Equal to or greater than $2,500,000.00 | 3.0000% | 3.04% |

Rates are accurate as of 2/3/2026. Your interest rate and annual percentage yield may change. At our discretion, we may change the interest rate on your account. We may change the interest rate on your account at any time. There are no maximum or minimum interest rate limits for this account. Interest will be compounded monthly and will be credited to the account monthly. If you close your account before interest is credited, you will receive the accrued interest. You must deposit $1,000.00 to open this account. A service fee of $10.00 will be imposed every month if the average daily balance for the month falls below $1,000.00. You must maintain a minimum average daily balance of $5.00 to obtain the disclosed annual percentage yield. A dormant account fee of $5.00 per month will be charged after 12 months of inactivity. Interest earnings credited to the account, if any, are not considered account activity.

We use the average daily balance method to calculate interest on your account. This method applies a periodic rate to the average daily balance in the account for the period. The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period. The average daily balance that we use when calculating interest is the collected balance. That means we only include those funds for which we have actually received payment when we determine the average daily balance on which interest is paid. Interest begins to accrue no later than the business day we receive credit for the deposit of noncash items (for example, checks). Withdrawals from your MMDA are limited to six (6) per statement cycle. A fee of $10.00 will be charged for each transaction in excess of limit. Please refer to the separate Fee Schedule provided to you with this disclosure for information about fees and charges associated with this account. A Fee Schedule will be provided to you at the time you open an account, periodically when fees or charges change, and upon request.

SuperSaver Savings

| Daily Balance Range | Interest Rate | Depending on Account Balance, Annual Percentage Yield (APY1) will: |

|---|---|---|

| $0.01 to $500.00 | 10.00% | Equal 10.47% APY |

| NEXT $500 $500.01 to $1,000.00 |

5.00% | Range from 10.47% to 7.79% APY |

| NEXT $1,000 $1,000.01 to $2,000.00 |

1.00% | Range from 7.79% to 4.40% APY |

| Greater than $2,000.00 | 0.10% | Range from 4.40% to 0.10% APY |

1 To qualify for the Annual Percentage Yield (APY), the following requirements must be met during a monthly statement cycle: Minimum of one (1) Round-Up transfer2 from checking account; minimum of one (1) deposit of at least $30 or two (2) deposits of at least $15; no withdrawal transactions; receive e-statements. If eligibility requirements are not met, the interest rate will be 0.10% with an APY of 0.10%. Interest is compounded and credited monthly. $10 minimum opening deposit required. The APY is accurate as of 2/3/2026. The interest rate on this variable rate account may change at any time at our discretion. Each primary account holder is allowed one (1) SuperSaver account per tax identification number.

2 Round-Up transfers must be posted, not pending or processing.